Volatility Impacts Global Commodity Markets

It’s a historic time for corn, soybean and all commodity markets. As farmers prepare for planting and determining crop rotations, they’re keeping rising input costs in mind, of course. But there is also a great deal of heartburn over the uncertainty of commodity prices all across the board.

How we got here

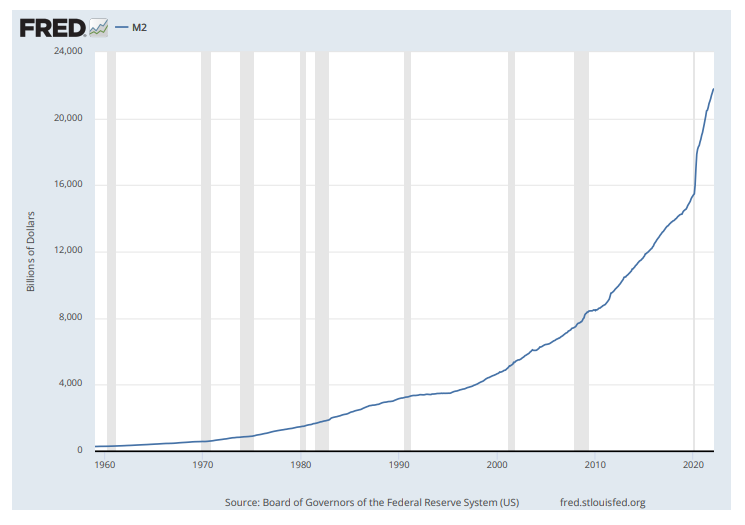

The latest phase of volatility can be linked to early 2020, as COVID 19 spread across the globe. The U.S. government -- including the Treasury, the Federal Reserve, the President, and Congress -- reacted with unprecedented responses to the situation. The Government enacted PPP loans for small businesses, lowered interest rates, expanded unemployment insurance, and issued stimulus checks for families and individuals. These measures were quickly put into place to support and assist Americans through the economic crisis brought on by the pandemic. This resulted in a 40% increase in U.S. money supply (M2 dollars) created in the last two years.

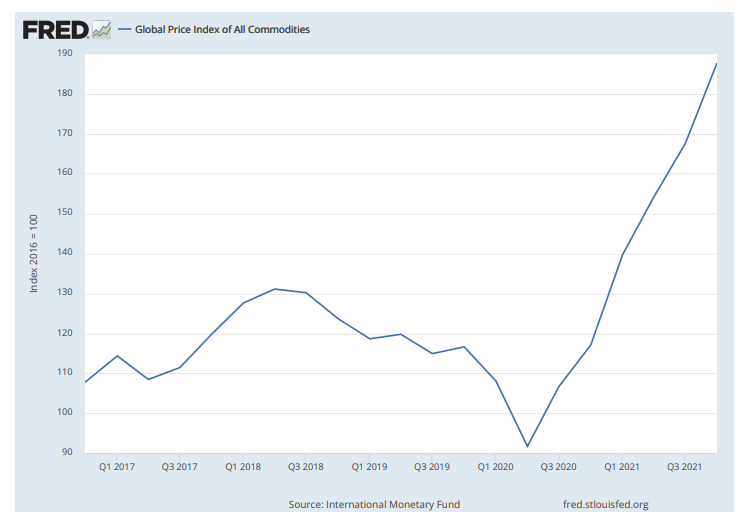

In turn, the producer price index, specifically for commodities, rose by approximately 33%. During the same period, the median home price increased by 25%.

As supply chain issues became more challenging, the pandemic took the normal demand-led market to another level for commodities across the board, from crude oil to corn they all started to feel the impact of higher input prices.

Grain marketing decisions

Unfortunately, grain markets were impacted from many sides, not just the demands on the supply chain. Dry weather in South America over the past 24 months have reduced grain yields and the current conflict between Russia and the Ukraine is causing many in the industry to hold their breath as supplies are further threatened. The region has traditionally led in global fertilizer production and played a major role in wheat and oil seeds production as well. This leaves us stuck with market volatility for the unforeseeable future.

Thankfully, at the same time, the demand for U.S. soybeans from China has remained steady. That, with the dry weather South America has been experiencing, could put the U.S. as the “go to” producer for soybean exports after next harvest.

All of these factors contribute to the making U.S. farmers’ marketing decisions more challenging than ever. Some producers are leaning a little bit heavier towards soybeans than in recent years, particularly if they haven’t yet purchased their fertilizer.

If producers haven’t caught up on fall sales yet, it could be a good time to consider hedging by catching up on fall sales of new crop. In these inflationary times, a few more acres could be added or there’s more carryout at the end of the year for a number of reasons. If those things happen, it could really deal the market a big surprise in the fall. Also, let’s not forget, the 2022 cost of production per acre will be a record high, meaning a lot of your hard-earned dollars at risk. Regardless of what happens, if you haven’t sold for next year, now is a good time get some of those bushels sold.

The National Agricultural Statistics Service or NASS released their March 31, 2022 planting intentions report and they predicted slightly less corn acres in the US at 89.5 Million. As we move into the growing season domestically, the estimates for carryout on corn will be around 1.6 billion bushels. That sounds like a lot, but with exports and biofuels going strong, we are using more corn than ever before. Given the lower soil moisture in many parts of the US and higher fertilizer prices, the question will be whether or not the U.S. can produce the estimated 181 bushel per acre national average yield which was published in February 2022 from the Agricultural Outlook Forum data. The weather this growing season in the corn belt will be watched closely by everyone.

Soybeans, at an estimated national average yield of 51.5 bushels per acre by the forum, may seem more attainable. The yield and US prospective planted acres from NASS of 91 million acres for Soybeans will lead to carryout estimates of around 470 million bushels at the end of the 2022 marketing year. The way many successful producers have ridden through past volatility is by playing it down the middle and building some hedges in their marketing program, rather than trying to outguess the markets all one way or the other.

Another influencer that could impact commodities going forward is renewable diesel. We’ve heard a lot about bio diesel in the past, but renewable diesel is much different. Renewable diesel takes it a step further, with a “greener” score than bio diesel, because the whole product is made from renewables. The soy oil market has been quite strong as a result for the demand for renewable diesel. The next generation of bio fuels, made by corn, is also on the horizon. The lower environmental impacts of these fuels are important to the consumers of this commodity, which will also, likely, further increase demand.

Risk Management:

Current corn and soybean prices are as high as we’ve seen in some time and yields over the past several years have been very good. This gave producers the opportunity, with crop insurance, to buy up to 85% and lock in solid revenue. In addition, the supplemental and enhanced crop insurance options afforded producers a great opportunity this year, as well. With these options it’s possible, with to get up to a 95% coverage guarantee on these valuable crops.

Other tools to leverage – to take some of the unknowns out of the equation -- include locking in interest rates and staying ahead of chemical and fertilizer purchases.

First Steps:

Have a discussion with your crop insurance officer, crop advisors, and your lender to get their perspective on the risks you have and the things you can control. The most important thing is to buckle up and be safe, and that means having a solid, customized risk management plan in place, hedging yourself on sales and locking in your inputs and fixed interest rates on any debt you may have.

Check out our agricultural podcasts for insights from Glenn and other Compeer Experts. For more information on crop insurance strategies, check out tools and resources.