Farmland Values Remain Resilient Despite High Interest Rates

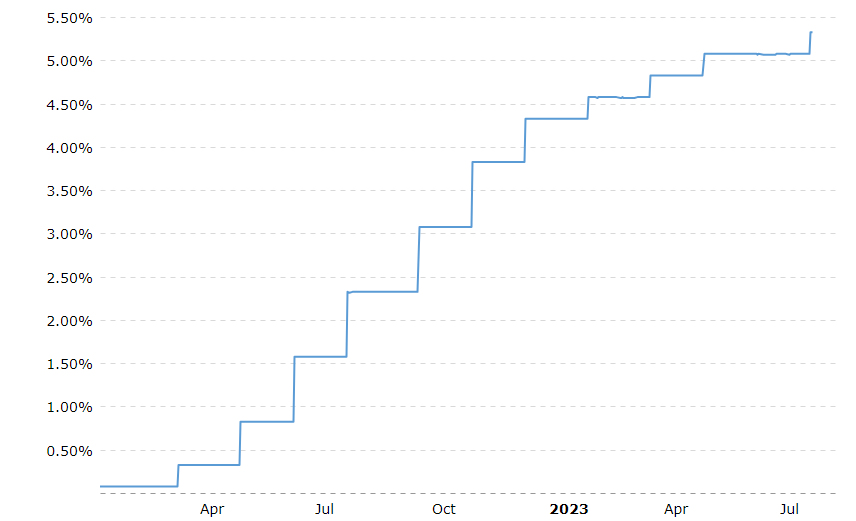

In an ongoing effort to curb inflationary pressures throughout the economy, the Federal Reserve increased the federal funds rate to 5.25 - 5.50% following the most recent Federal Open Market Committee (FOMC) meeting. In a statement following the meeting, FOMC Chair Jerome Powell stated “recent indicators suggest that economic activity has been expanding at a moderate pace. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated.”

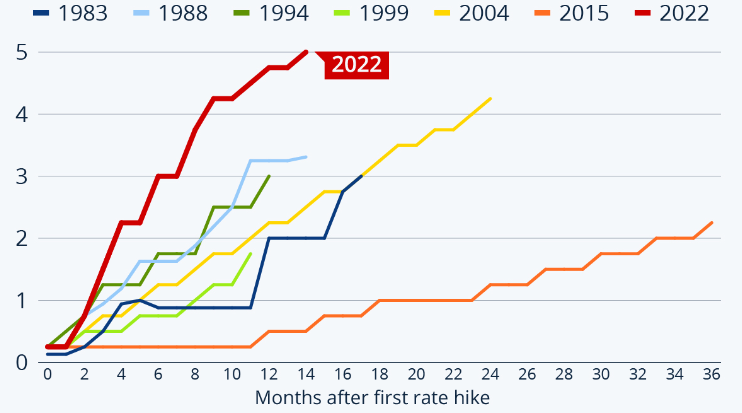

Citing a sound and resilient banking system, the FOMC continues to shrink the supply of money available for making purchases. This, in turn, makes money more expensive to obtain. The Committee reaffirmed its commitment to bring inflation down to a long-term rate of 2%. The recent campaign has been very aggressive over the past 18 months relative to other tightening cycles. Depicted in the graph below, the federal funds target rate has changed by 500 basis points since March 2022.

The relationship between land values and interest rates would be a relatively simple study if examined without influence by other factors. In a controlled environment, an increase to the cost of debt or financing would result in a loss of value to the asset. While increasing interest rates generally has the potential to affect land values, it is not uncommon for land values to remain high despite such changes. Here are a few reasons why this may occur:

Supply and Demand Dynamics: Land is a finite resource, and its availability is often limited in desirable locations. If the demand for land remains high while the supply remains relatively low, it can create upward pressure on land prices. Even with increasing interest rates, the scarcity of land can keep its value elevated.

Economic Growth and Development: In areas experiencing robust economic growth and development, land values can continue to rise due to increased demand from businesses and investors. Factors such as population growth, infrastructure development and job opportunities can contribute to sustained demand for land, outweighing the impact of rising interest rates.

Buyer Motivation: Relative to other investment classes, historically farm land is a tightly held asset. In an average year, less than 2% of all agricultural land is exchanged, creating an even smaller portion being conducted on the open market. When given an opportunity to purchase land, adjoining owners are often more highly motivated than other buyers to purchase a specific tract which results in higher prices.

Inflation and Asset Appreciation: When inflation is present, land values may increase as investors seek to protect their wealth by investing in tangible assets like real estate. Inflation can erode the value of currency, making land and other real estate properties attractive investment options, potentially leading to higher prices even with increasing interest rates.

Investor Sentiment and Confidence: Investor sentiment and confidence in the real estate market can also influence land values. If investors perceive real estate as a safe and profitable investment, they may continue to purchase land even with increasing interest rates. Positive market sentiment and confidence can help sustain high land values.

Development Potential and Zoning Regulations: Land with high development potential or favorable zoning regulations will often command premium prices. If a tract of land has the potential for development or is located in an area with favorable regulations for desired land uses (e.g., commercial, industrial, residential, etc.), its value may remain high despite rising interest rates.

It's worth noting that the impact of interest rates on land values can vary depending on the local real estate market, economic conditions and other factors. While rising interest rates generally increase borrowing costs and can dampen demand for real estate, other factors at play can mitigate the effect on land values and keep them high.

For more insight into the appraisal process or to find your local appraiser, visit Compeer.com.