Don't Let a Down-Turn Go to Waste

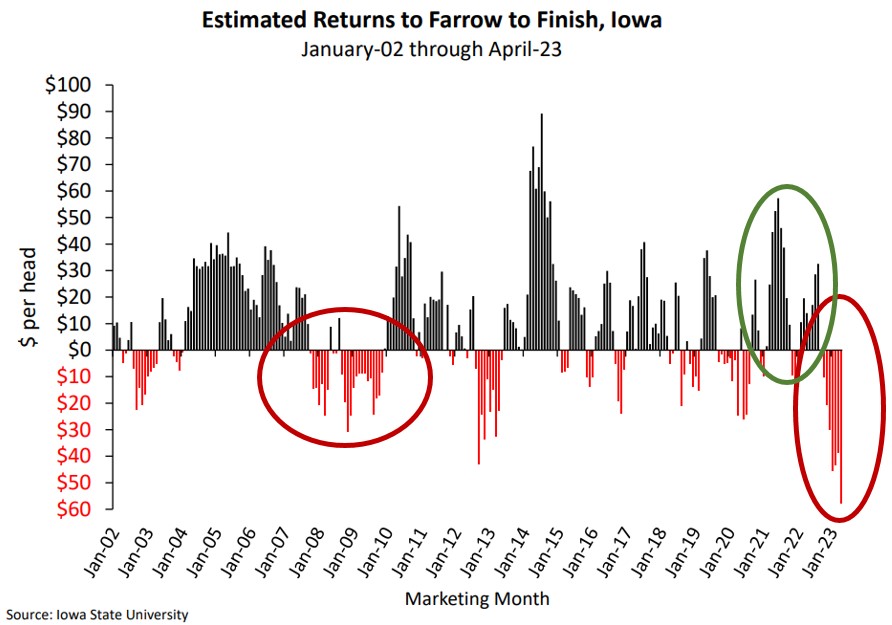

There’s no doubt that the U.S. swine industry is experiencing economic losses. Difficult times on the farm have led to rumors of farms liquidating sows and selling wean pigs for the cost of freight. When you look at Iowa State’s Estimated Livestock Returns model, producers started losing money in September of 2022 and have posted month-over-month losses ever since. If a producer was to sell one pig each month between September ’22 and April ’23, the aggregate losses would be about $249 which has averages $31/pig sold per month. For comparison, during the 2008-2009 downturn that spanned 26 months, where the Iowa State model factored only two months of profitability, losses were $318 using the same one-pig-per-month calculation. The current stream of losses is over 75% of the ’08-’09 losses in just 30% of the time. The chart below illustrates the cycle durations and magnitude with red circles around the current and prior significant industry down-turns. During the profit cycle following COVID, this approach resulted in $418 of profits from September ‘20-August ’22 as referenced by the green circle on the chart below. Recent losses have burned 60% of those profits.

With the forecasted outlook, analysts say we could see losses from $15 to $30/pig over the next 12 months. That would burn $180-$360 more equity under this scenario and push aggregated losses up to $430, and possibly over $600, on the one-pig-per-month illustration. If realized, it would nearly double the losses of ’08 & ‘09.

While these figures reference the Iowa State model, it is purely a model and serves the purpose of a barometer for producers to mark themselves against. The model doesn’t factor any risk management or LRP/LGM use. When we look at year-end financials, we saw that on average producers we work with closed out 2022 with operational profit just over $2.50/pig. Based on preliminary Q1 2023 numbers, the average operational loss may be $20/pig. That would be roughly half the losses represented in the Iowa State model, largely credited to hedging profits.

Forecast early and often using a stress test to see how market volatility will impact your business. Producers need to thoroughly understand their future cash, working capital and equity positions. Proactively communicating your plans for navigating these rough waters to your lender is critical. Protecting your balance sheet from excessive losses through risk management and focus on herd health will be key. Your primary focus as a producer should be on survival so you can take part in the recovery of the profit cycle, which is when farms have traditionally generated strong profits. The hard part is that no one knows how long it will take to reach that part of the cycle.

These cycles present opportunities for farms to play offense when it comes to succession planning. Most farms are always in some stage of succession planning. When valuations are stressed, it becomes much easier to move larger percentages of ownership to successor generations. Working with your tax advisor and estate planner may not be something top of mind during times like this, but it may be an opportunity to manage large estate tax exposure, which could put significant burden on farms when administering an estate settlement.

Times like this serve as a good test for assessing the next generation’s true passion and desired area of focus inside the business. Extremely passionate and dedicated future leaders will see the light at the end of the tunnel. It is refreshing to think about ways to play offense and plan for future growth beyond the recovery. Be prepared to pursue opportunities that may be presented through the chaos of the current losses. If forecasted losses and sustained financial stress is presented, there will likely be good, clean wean pig flows that come available. Losses of this magnitude could result in sow units, finishing sites, truck washes, feed mills and farm land that could come available for lease or for sale. Having a clear vision of priorities and what good opportunities look like for your operation will best position you for capitalizing on these opportunities.

It is always the darkest right before the dawn. Having a transparent understanding of your financial position and a clear vision for navigating through rough waters will be key to setting sail back out into smooth seas.

Source: Iowa State Model - https://www2.econ.iastate.edu/estimated-returns/

Daryl Timmerman is a senior swine lending specialist for Compeer Financial. For more insights from Daryl and the Compeer Swine Team, visit Compeer.com/swine.