A Roadmap for Pork Industry Resurgence

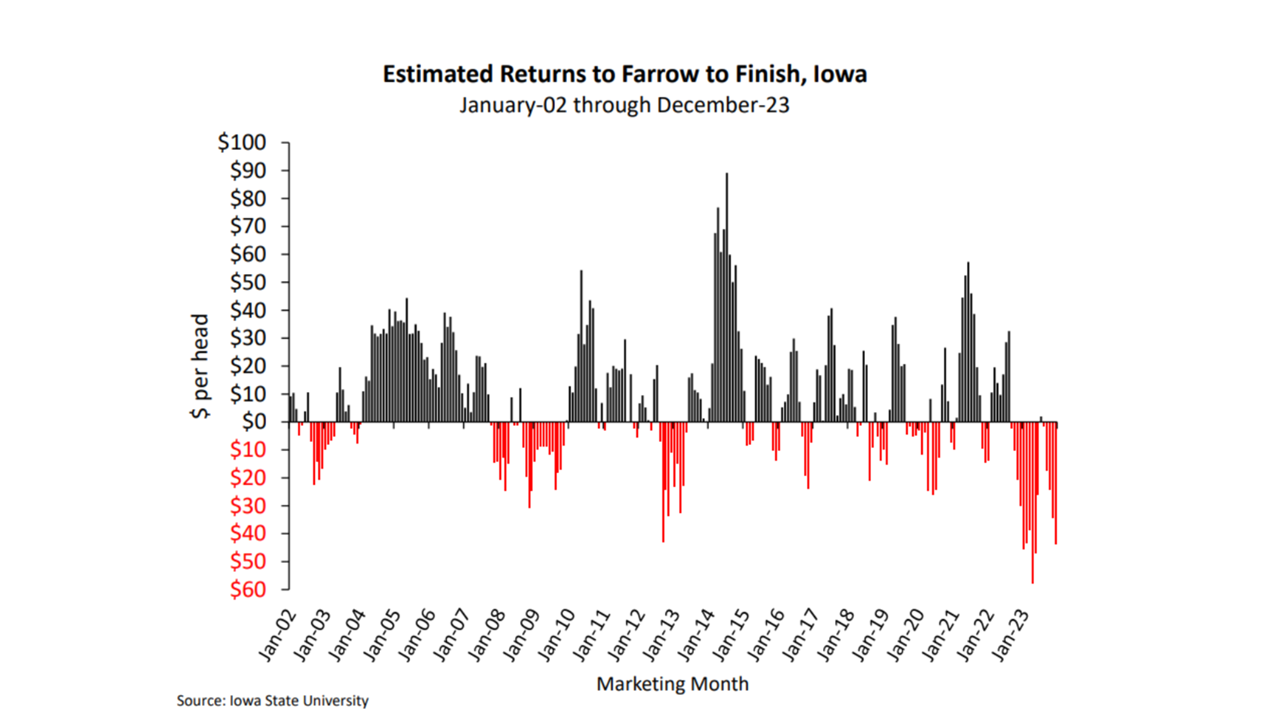

The past 16 months have been tough for nearly everyone involved in the pork industry, particularly producers. Examining Iowa State’s “Estimated Returns to Farrow to Finish” profitability chart, along with the multitude of calls and discussions I’ve had with pork producers, paints a stark picture of the industry’s challenges. Another significant sign is the financial database, revealing a 10% drop in equity for producers year-over-year by the end of the third quarter of 2023. Although year-end financial information is pending, it’s evident that 2023 remained challenging, adding substantial financial stress to numerous swine operations.

Despite the hardships, there’s a glimmer of hope on the horizon for the pork industry. The USDA’s December Hogs and Pigs Report indicates a continued reduction in the sow herd farrowings last fall, down 4.0%. Additionally, the forecast anticipates a continued reduction in the sow herd moving into next May. Encouragingly, pigs per litter increased by 3.9% year-over-year from the September-November period, aligning with producers reporting improved production and decreased mortality rates on their farms. Given the available information, what decisions are pork industry owners making to mitigate financial risks?

Monitoring the futures markets in the pork industry since the start of January provides a ray of hope, suggesting potential profits in the near future. The June contract has witnessed almost a $10 per hundredweight (cwt) improvement in price since the beginning of the year, fueled by plummeting grain prices. This improvement in the hog crush this summer could result in profits ranging from $30 to $40 per head, presenting the awaited opportunity. The crucial question owners must ask themselves is whether they can afford to risk missing out on locking in good profits, only to see the margins vanish.

Before making decisions for your hog farm, consider a couple of vital questions. Firstly, are you aware of your cost of production in a lower-cost environment? With feed cost reductions, most operations will see a shift from a $100/cwt. cost to the mid $80s or lower. As you reduce costs, bear in mind that lower inventory valuations on your balance sheet will offset these savings, impacting earnings. Understanding the cost implications is crucial for making informed decisions. Secondly, engage in a discussion with your lender about your risk management strategy, especially if you plan to use the futures markets to lock in profits. Even if your lender is skeptical, a Livestock Risk Protection (LRP) strategy can be an alternative to secure profits. Given the stress on balance sheets over the past 16 months, having your lender onboard with your risk management plan is vital for liquidity in handling potential market fluctuations.

With current hog prices, there’s hope for rebuilding lost equity in the second quarter of 2024. The question remains: can you afford to miss out on this opportunity?