Decode Swine Market: Econ Shifts & Real Estate Valuations

Compeer Financial has a specific mission to enrich agriculture and rural America. With the agricultural industry at the heart of our business, Compeer serves a wide range of clients and their operations. The swine market plays an important role within our organization given the geographic location of our territory, with swine consisting of about 7% of the total portfolio, historically.

The swine industry over the last few years has had many positive trends that have shaped the growth and trajectory of this current business cycle. Producers are constantly pushing production per sow to new highs with advancements in genetics, health & bio-security, feed efficiency & nutrition research, and technology & innovation. In addition to these advancements, a focus on sustainable practices and animal welfare have also been positive strong trends within the industry.

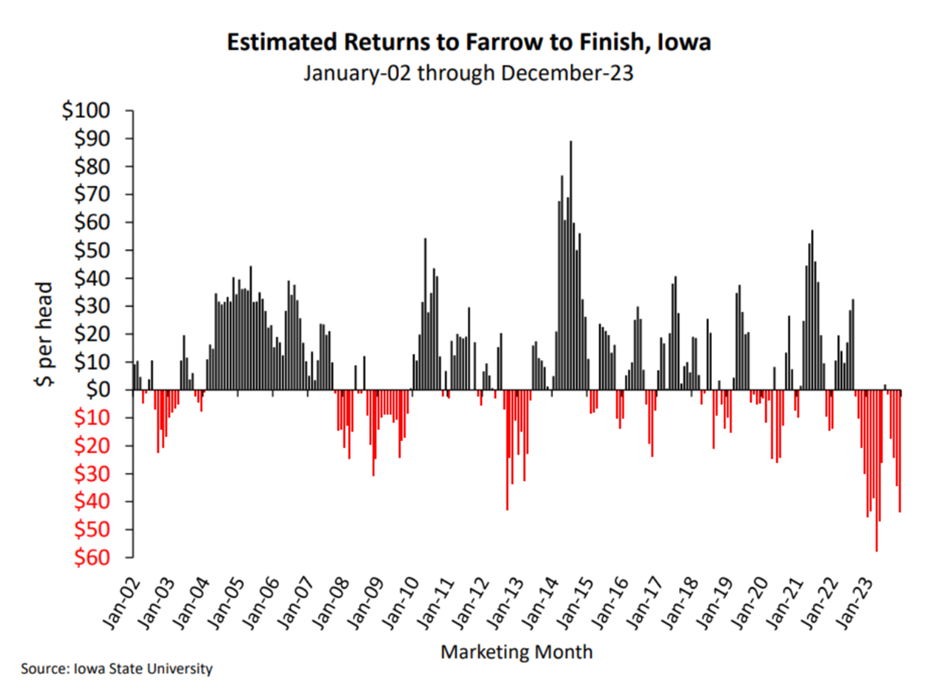

Swine production has historically been a volatile industry, with periods of good returns and other periods of losses. The past year was a turning point from positive returns to negative, sustained losses. The chart to the right from Iowa State University visually shows the estimated profitability of producers over the last couple of decades; it can be easily ascertained that the recent downturn is one of the deepest and longest stretches of losses in the last 20+ years. The prior year saw many troubling headlines including bankruptcy announcements, facility closures, and bleak demand projections.

A number of factors contributed to this downturn, with shrinking demand, over supply, and persistently higher input costs being the main drivers to the loss of profitability. There has been and will continue to be some stress and friction while the market works toward an equilibrium.

What does this mean for swine related real estate asset values? Understanding this industry shift from expansion to contraction has been a top priority for the specialized appraisers on our team. The issue sometimes with appraisal and drastic shifts in the market is that appraisal practice stems from market transactions and those can take time to manifest and capture. One thing that was noted prior to any actual research or analysis, was that the number of listings of swine confinements increased significantly throughout 2023. As of January 2024, there were approximately 115,000 finish spaces publicly advertised for sale. This is a very large increase above what we have seen previously, especially given that swine confinements were often privately advertised, typically by word of mouth before. With 2023 at an end, it is possible to now analyze our sales data and measure any changes relative to historical value trends. The hypothesis was that there had to be a softening in swine real estate assets, just based on the general industry stress and the amount of assets listed for sale.

Before getting into some of the results, some background on the appraisal of swine confinements is needed. Swine confinements are highly improved, specific use properties with little to no other feasible uses. Therefore, it is important to understand the correct processes to value these specialized facilities. The topic of depreciation is one of the most important factors to have a handle on. Depreciation, in its simplest form, is defined as a loss in property value from any cause. Depreciation can be caused by physical reasons, such as general aging, deterioration, or breakage. Depreciation can also be caused by other forces which fall under the obsolescence category. There are two types of obsolescence, functional and external. Functional obsolescence is a market discount attributed to the facility itself, such as inadequate equipment, size or layout of the facility, or the presence of a superadequacy (something considered overbuilt by industry standards). External obsolescence is a discount by the market due to conditions outside of the property, such as unfavorable economic conditions, locational desirability, or supply/demand issues. Therefore, by analyzing the obsolescence rates of market sales, I am able to measure changes in trends determined by the actions of market participants. Remember, the expectations prior to the analysis were that swine finish barns have likely seen an increase in obsolescence due to the dramatic change in economic conditions.

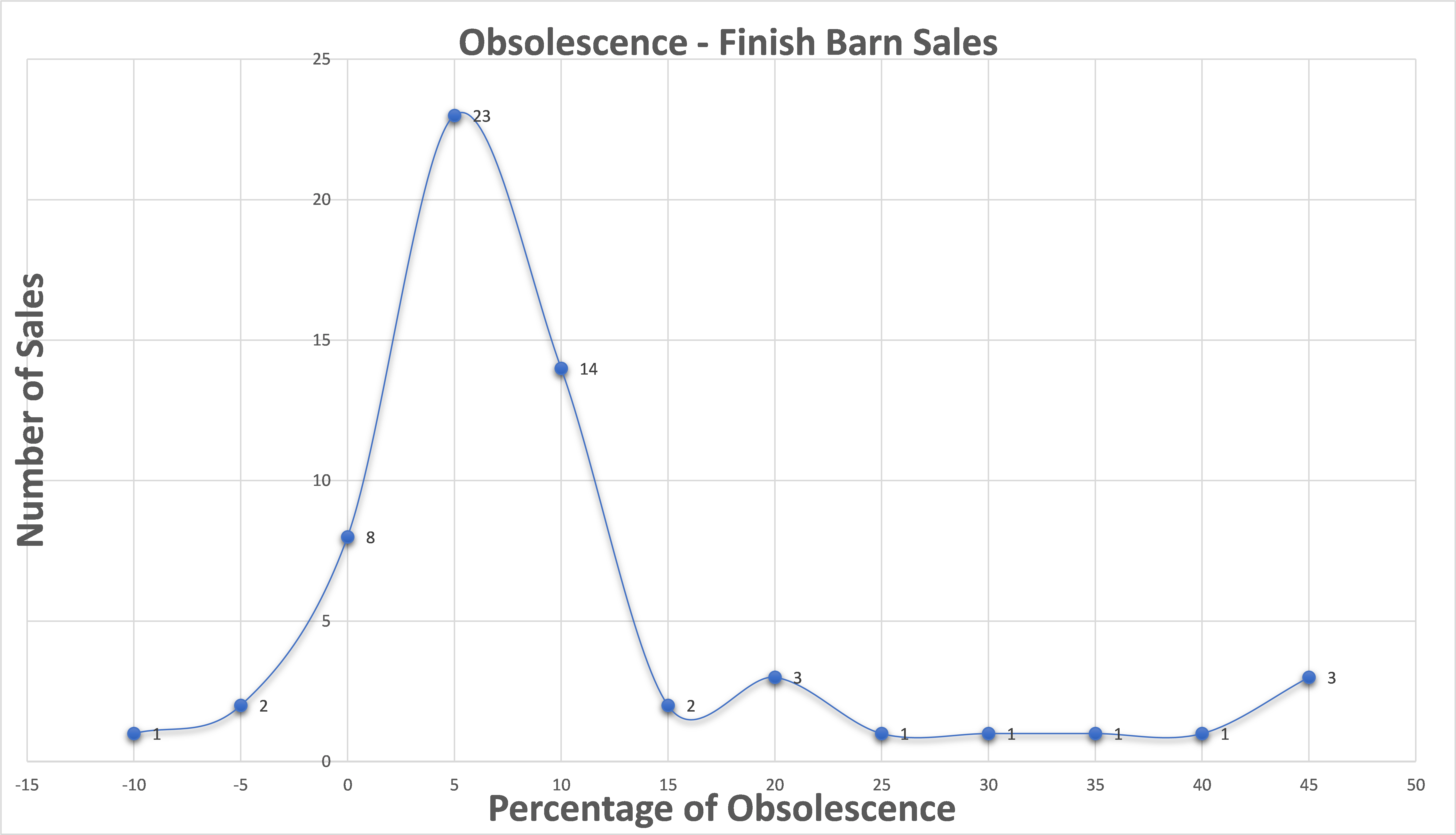

Summary of the dataset: There were a total of 61 finish barn sales from 2021 – 2023 utilized for this analysis. The finish barn sales chosen were a range of ages, locations, and sizes. I thought it better to have more sales in the set, rather than limit the overall number due to comparability restraints. Focus was limited to finish barns as they are considered much more prevalent and homogenous in the market. Here is the chart of the entire dataset:

Overall obsolescence rates ranged from -10% to 54%, which is a very wide range. However, when analyzing them by year, there is an observable increase in obsolescence from 2021 to 2022 and from 2022 to 2023.

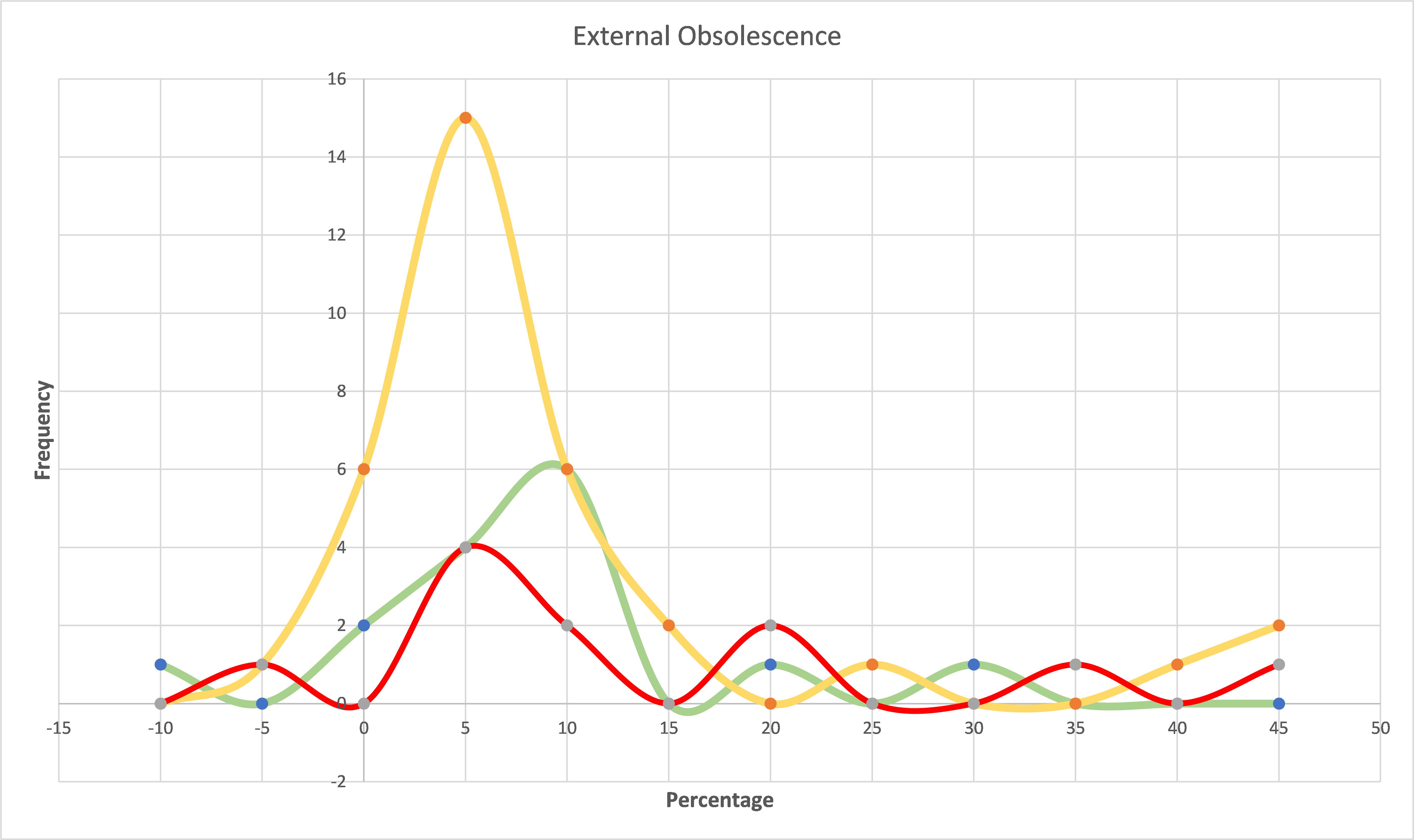

Drilling down deeper into the data, the sales are arranged based on their effective ages as follows:

- Group 1 being the newer barns of 7 years effective age or less.

- Group 2 being 8 to 15 years effective age.

- Group 3 being 16 years effective age and older.

This was done to see if there was any difference in obsolescence rates across different aged barns.

- The results of Group 1 were that the rates were fairly constant across all years and had a maximum range of only 20%.

- Group 2, the middle-aged barns, had similar results of consistent year to year averages, however Group 2 had a much wider range of 49%, which indicates much more variability between sales.

- Group 3, the older barns, did show a significant increase in obsolescence in 2023 compared to previous years – a 95% increase over 2022. The range of sales was also extremely wide at 63% spread.

This reinforces the hypothesis, but this analysis helped determine which properties may be at more risk for discount. The chart below simply illustrates the range and frequency of obsolescence observed for each group.

The conclusion from this analysis therefore is that early to middle life swine finish barns have not been shown to be as negatively affected by the downturn in economic conditions. The older aged barns, on the other hand, have shown significant increases in external obsolescence. These results make sense logically, as the swine herd contracts due to lack of profitability, a lower number of market hogs leading to empty finish barn space. Producers are generally going to fill the barns in better condition and long-term appeal when given the chance. The number of barns listed for sale throughout 2023 also contribute to an over supply of barns, which in turn results in a discount in the form of external obsolescence.

This article was intended to provide an informative update to the changing swine industry, as well as provide readers a glimpse into some of the data collection and analysis that the Compeer Appraisal team prepares to determine informed opinion of values on specialized properties. The results are a reminder that rapid changes in economics can and do have an effect on asset values to a portion of or the entirety of an industry, and it is our job to determine and measure the effects based on market derived information.