Financial & Health Challenges in the Pork Industry

I recently attended the National Pork Industry Conference in Wisconsin Dells. The overall tone of the conference was notably somber. Health challenges, continued financial losses and various other issues have been plaguing producers. As a lender, I contributed to this negative undertone by presenting the current financial numbers, which unfortunately painted a challenging picture.

It’s evident that the pork industry is grappling with significant hurdles. Mounting financial losses, labor shortages, persistent health challenges and growing environmental concerns are weighing heavily on producers. This confluence of issues has created a perfect storm that demands innovative solutions and renewed perspectives.

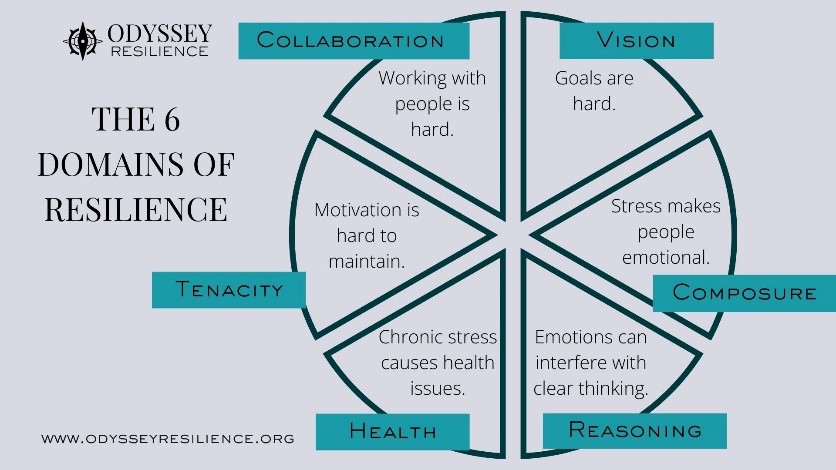

Fortunately, there was a pivotal moment at the conference that injected a sense of optimism and hope among the attendees. Kiley Schmitz, the co-founder of Odyssey Resilience, delivered a compelling presentation titled “Redefining Resilience – Going from Surviving to Thriving.” Her focus was on “The Six Domains of Resilience: Vision, Composure, Reasoning, Health, Tenacity and Collaboration.” Her message was both clear and inspiring, offering practical insights on how to navigate the current challenges.

The pork industry has always been resilient, even in the face of adversity. Every downturn often feels more prolonged and sever than the last. When I began my lending career in 1997, I quickly encountered the uncertainty of $8.00 hogs and a lack of packer capacity. During that time, both producers and lenders had to learn not just how to survive but how to thrive and grow the industry amidst adversity. Then, the subsequent impact of the H1N1 swine influenza virus presented significant challenges that nearly decimated the U.S. pork industry. It wasn’t until the Circo vaccine became available that the industry saw some relief.

Despite the ups and downs, the hog cycle has remained robust, and the industry continued to grow. The farm resilience and tenacity of producers enabled the industry to recover and move forward. The lessons from 2008-2009 have been invaluable, providing producers with strategies to enhance their operations today. Trust me, the Compeer Financial swine team and farm advisors much prefers discussing growth opportunities over worrying about financial covenants.

Ownership in the pork industry comes with its own set of challenges and stresses, particularly when making decisions that affect employees or vendors. If you ever feel overwhelmed, leverage resources like those offered by Kiley Schmitz’s team. Her advice, such as recognizing that “stress makes people emotional” and understanding that “emotions can interfere with clear thinking,” underscores the importance of reaching out to trusted farm advisors for support. You’re not alone in this journey and seeking input can often provide much-needed clarity and perspective.

I firmly believe in the enduring strength of the U.S. pork industry. Despite the current challenges, this industry will not only survive, but thrive once again. The resilience inherent in our producers is a testament to their ability to navigate and overcome adversity. As we embrace the insights shared by leaders like Kiley Schmitz and continue to support one another, we can look forward to a brighter future for the pork industry.

Swine

If you are a pork producer, there’s no one better to have on your side than Compeer Financial. Small or large, our team works to help hog producers who want to expand or join the swine industry.