Pork Industry Sees Stable Building Costs, Shifting Rates

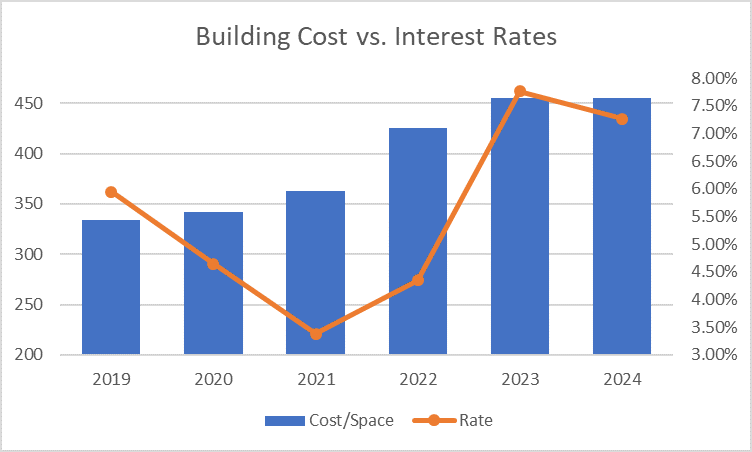

Over the past three years, we’ve compiled a comprehensive dataset on building costs and interest rates, which are critical considerations for pork producers. In the current high inflation environment, it is clear that heightened building costs are becoming the new normal for swine operations. Additionally, while interest rates have historically been manageable, they have risen noticeably from levels familiar to us not too long ago.

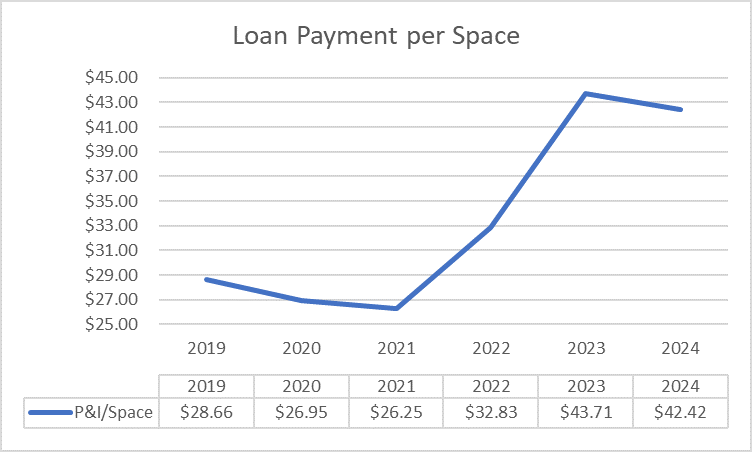

Last year at this time, we discussed a long-term trend regarding building costs and interest rates. As we revisit the topic now, armed with updated data reflecting 2023 actuals and 2024 projections, we observe a stabilization in building costs and a slight pullback in interest rates. The graphs below illustrate this trend, focusing on a standard 2,400-head wean-to-finish barn under the following assumptions:

- 15-year term loan

- 85% loan financing

- Solid borrower credit

- Southern Minnesota and northern Iowa cost averages

- Costs include all aspects except land

- Rates may vary based on specific loan pricing, products, young farmer program qualifications and terms

The interest rates were recorded in early to mid-January of each respective year and are based on above-average borrower credit.

Overall building costs for the site can change based on your equipment package, material quality and other factors, but the trend captures what pork farms have been experiencing across the countryside.

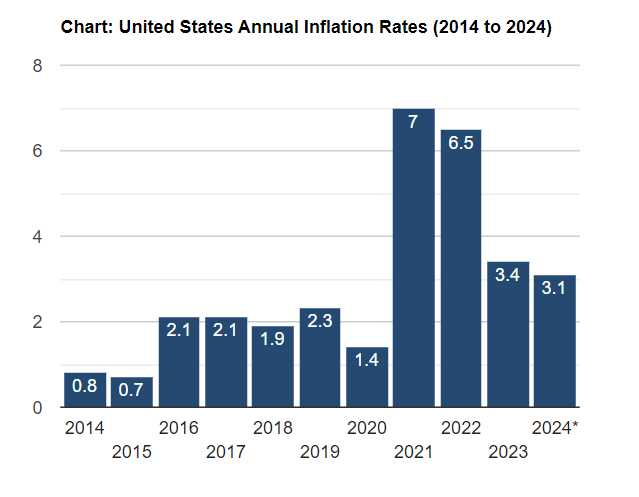

Source: www.usinflationcalculator.com

There are a few key points swine operations can consider when analyzing this data:

- Since 2020, overall building costs have surged by approximately 30%. This escalation became particularly pronounced after the onset of the pandemic and has since stabilized over the past two years. While unsurprising, it’s noteworthy that the rise in building costs mirrors the general inflation rate data in the U.S. (chart above)

- Throughout 2020 and 2021, interest rates experienced a decline, offsetting the surge in building costs. However, present conditions reveal increased borrowing costs, with certain rate products currently hovering around the 7% range. Consequently, we’ve witnessed a significant increase in principal and interest per pig space from 2021 to 2023, with a slight decrease observed in 2024. To maintain the same loan payment per space as in 2022, a down payment of approximately 30% is now required – a marked increase compared to the 15% capitalization rate utilized in the 2022 scenario.

In addition, two important questions deserve some thought:

- Are pork farms building enough spaces to offset the ones that have been decommissioned or are needed to keep up with genetic improvement and more pigs marketed per sow? While we don’t have a definitive answer for this challenge, it’s a trend worth monitoring closely, and it will be interesting to see how it all unfolds.

- The average age of pork producers is on the rise. Many producers who built barns during the pork industry growth phase are now approaching retirement. While this might initially seem like a hurdle, it also presents an opportunity to transition these assets to young farmers. Although these assets may require reinvestment, they can offer a beginning farmers a facility with potentially more attractive cash flow.

It’s important to highlight the positive aspects of constructing new grow-finish hog barns. Firstly, the manure value derived from these swine operations can significantly enhance cropping operations. Secondly, hog barns have traditionally maintained their values as equity builders. Moreover, the income generated from this investment can be effectively managed through depreciation.

We remain in a dynamic and challenging period. However, challenges often present opportunities. When making borrowing decisions, swine operations should thoroughly evaluate each opportunity, considering all angles to gain the necessary insights into how it will impact and enhance their pork farm business both now and in the future.

Swine

If you are a pork producer, there’s no one better to have on your side than Compeer Financial. Small or large, our team works to help hog producers who want to expand or join the swine industry.

A Roadmap for Pork Industry Resurgence

Unlock profit potential on your hog farm as the pork industry experiences a resurgence. The futures are up and there is hope – read now so you don't miss out on this opportunity!

Compart Farms: 74 Years of Family, Pork & In…

Compart’s pork is an industry leader. Explore their commitment to technology and advocating for sustainable practices while raising high-quality Duroc pork.

Self-Paced eLearning

Access self-paced courses covering a wide range of farm financials.