Understanding the Benefits of Enhanced Coverage Option (ECO)

In today’s uncertain agricultural environment, risk management is essential for protecting your farm’s future. Crop insurance plays a pivotal role in mitigating risks from weather to market fluctuations, but did you know there’s an additional way to safeguard your crops and income?

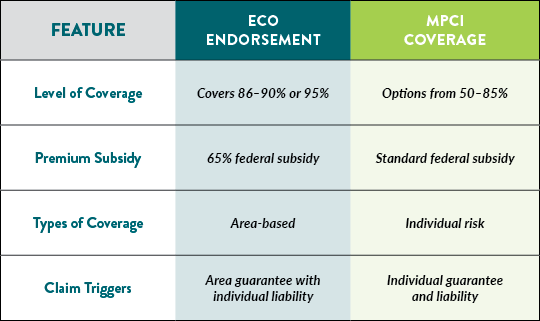

The Enhanced Coverage Option (ECO) is an endorsement to your existing multi-peril crop insurance (MPCI) policy that provides extended protection. And with the new crop insurance subsidy increase (prior in 2024 was 44%, in 2025 increased to 65%), growers should take an extra look as ECO is now more affordable than ever.

What is the Enhanced Coverage Option (ECO)?

ECO is designed to provide an extra layer of protection beyond your standard MPCI policy. It covers county-based losses, offering coverage at 86-90% or 95% on all your planted acres. This means that when severe weather or drastic market shifts hit, your financial safety net is wider and more robust.

The federal subsidy increase from 44% to 65% has made this coverage expansion more affordable. If you’ve been considering adding ECO to your crop insurance, now is the perfect time.

Why Should You Add ECO to Your Crop Insurance?

- Higher Coverage Levels

ECO provides coverage levels that range from 86-90% or 95%, significantly higher than what standard MPCI offers. This added protection can cover county-level yield or revenue losses due to natural disasters, adverse weather or market price fluctuations that affect your bottom line. Shallow loss coverage at 95% has a much higher frequency trigger than standard or base policy coverage levels. - Affordability with a 65% Subsidy

Thanks to a recent increase in federal subsidies, the cost of adding ECO to your crop insurance plan is much lower than in previous years. With a crop insurance subsidy increase to 65%, farmers can now access this valuable coverage at a fraction of the cost, ensuring that you get the protection you need without straining your budget. - Protection Against Market Volatility

Agriculture is a business deeply affected by the market. Prices for crops can fluctuate rapidly, and ECO helps ensure you won’t face the full brunt. By extending the coverage levels of your MPCI, ECO offers revenue protection to help stabilize your farm income if prices drop unexpectedly.

Compeer Financial is Here For You Every Step of the Way

We know that every farm is different. That’s why we tailor your crop insurance to fit the specific needs of your operation. Whether you’re interested in adding ECO to your policy or exploring other insurance options, we’re here for you. Our team of specialists will work with you to develop a customized risk management strategy that provides peace of mind throughout the growing season.

For more details on ECO and other crop insurance options, contact your crop insurance officer. Compeer Financial is here for you as a trusted partner. We’re here for you with the tools, resources and personalized support to help you farm thrive.

Crop Insurance

Crop insurance provides farmers with risk management tools to protect against crop loss or the loss of revenue due to declines in crop prices.