Will Farmland Values Follow Historical Benchmark Trends?

Will Farmland Values Follow Historical Benchmark Trends?

Predicting where the markets will go has long been a fool’s errand. But reviewing historical data in an effort to understand trends can provide critical insights for farmers and investors looking to buy or sell farmland real estate.

The Current Farmland Value Climate

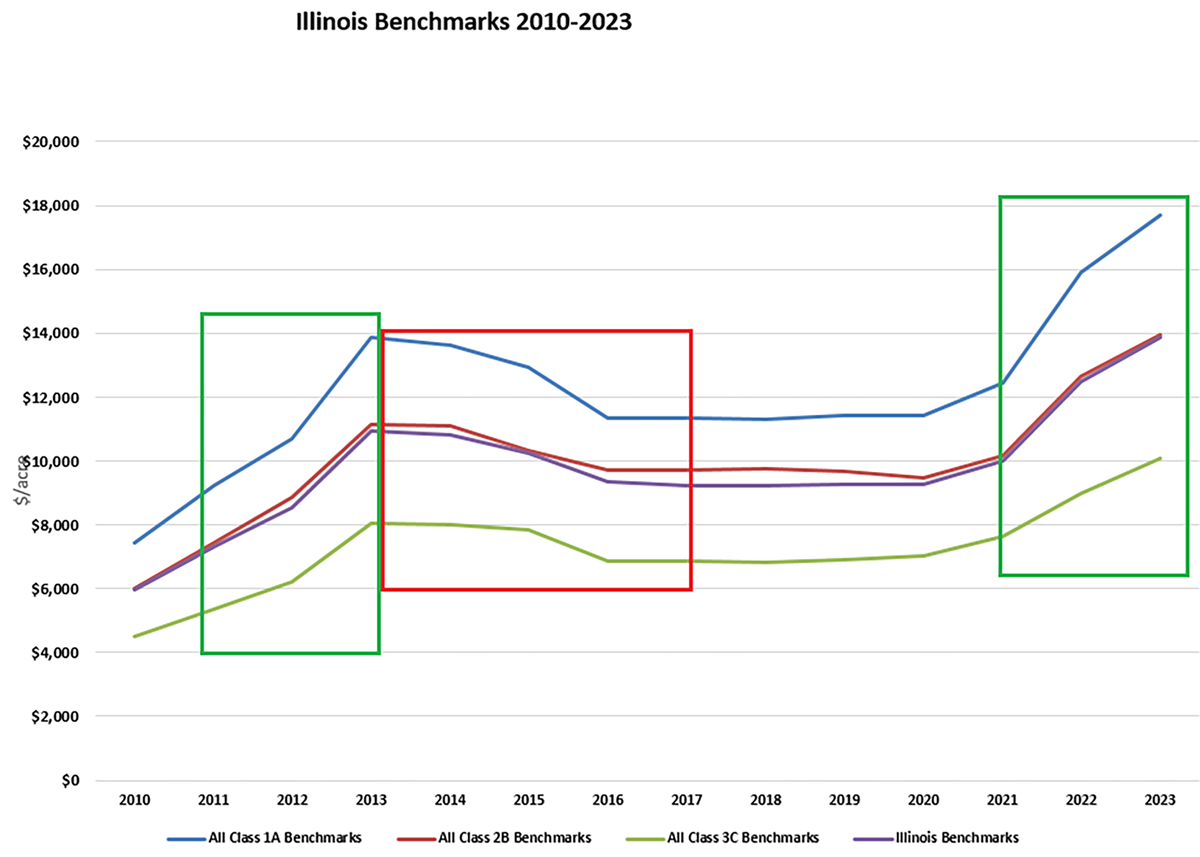

Historically low interest rates, strong farm profitability and high inflation drove farmland values to record levels in recent years. Compeer’s appraisal team valuates 53 benchmark farmland properties throughout Wisconsin, Minnesota and Illinois monthly to gather data in real-time. Benchmark data showed a 39-64% cumulative increase in farmland values from July 2021-April 2024, as illustrated in the chart below.

Chart 1: Historical benchmark farm values (Illinois used for illustration purposes)

Despite softening commodity prices and rising interest rates, values have remained relatively stable. This resilience may be partly due to strong farm profitability, which has enabled many producers to reinvest in land without the need for financing.

The past six months of data reveals a 1.3% average increase across all 53 benchmarks, although there is some variation between states. Wisconsin benchmark farms showed a 4.2% increase overall while some Illinois and Minnesota benchmarks showed slight declines in value.

This trend of relatively flat farmland values prompts several questions. Will the higher financing costs eventually suppress land values? Are farmers and investors viewing farmland as a shield against inflation, dismissing other investment avenues?

Conventional wisdom would tell you that along with a dramatic rise in interest rates, land values should decrease. But this anticipated decline hasn't been pronounced yet.

A Look Back: Historical Patterns Informing the Future

Compeer has annually compiled their benchmark data for more than 30 years, tracking values and what influenced them. When we examine historical commodity price trends and compare them to our historical benchmark farm data, it starts painting an interesting picture.

|

You don’t have to go very far back in history to find a similar surge in commodity prices that led to elevated farmland values. During 2011-2013, benchmark farms increased by 49% in Illinois, 64% in Minnesota and 31% in Wisconsin.

Once commodity prices began dropping in fall 2013 through 2017, farmland values decreased by 16% and 18% in the primarily row crop states of Illinois and Minnesota, respectively. Wisconsin values increased by 4%, demonstrating the dairy industry’s influence on land values.

This historical context underscores the potential for a similar trajectory for today’s market conditions. Will farmland values undergo a moderate correction in alignment with commodity prices and economic influences – especially in row crop heavy markets?

The Role of Supply and Quality in Farmland Valuation

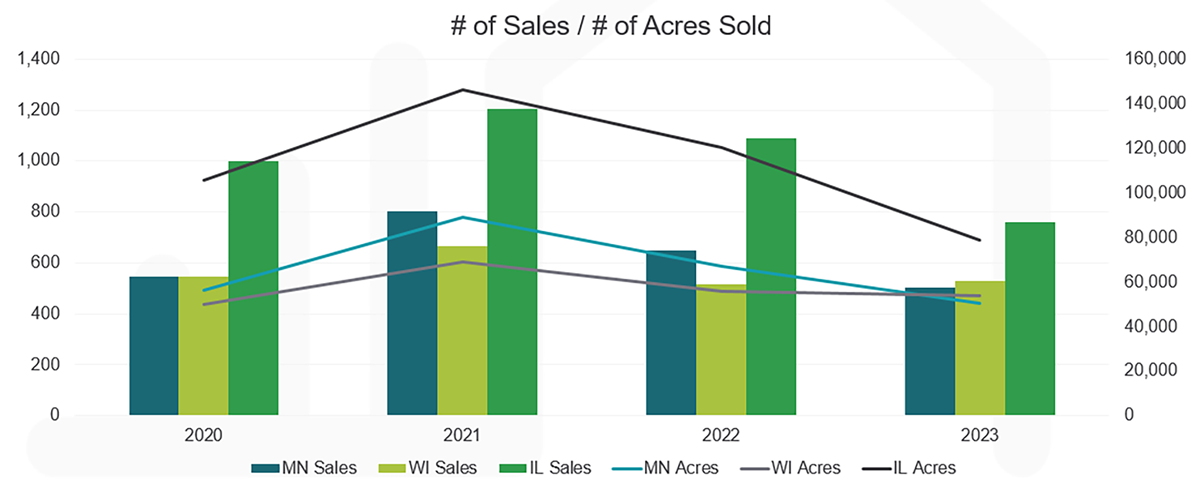

The supply and quality of farmland significantly impacts farm values. Our appraisal reports indicate a 500-700 decrease in the number of sales for available acreage in recent years. 2023 brought the lowest number of sales and acres in both Illinois and Minnesota in the past four years, as seen in the chart below. Wisconsin has been resilient, echoing the disparity in trends thanks to its industry diversity.

This sizable overall decline underscores the reduced supply's role in sustaining land values. The old Mark Twain adage, 'buy land, they’re not making it anymore,' still rings true, particularly in rural America. However, supply cannot sustain values forever.

Chart 2: Volume of sales transactions and number of acres sold

Quality also emerges as a decisive factor. High-quality land remains in demand, while interests in more marginal lands wane. As the market transitions, a divergence becomes apparent, highlighting the importance of understanding nuanced market behaviors at local and regional levels.

Implications and Strategic Considerations for the Farmland Market

Will history repeat itself? Several market-changing factors will shape the landscape over the next few years including the duration of the low commodity price cycle, the speed and extent of interest rate shifts and supply levels.

The continuous evolution of the farmland market prompts strategic considerations for potential buyers and sellers. With whispers of declining values and concrete data from historical periods, staying informed is more critical than ever. As factors such as interest rate movements and global commodity price shifts loom large, stakeholders should seek advice from trusted advisors and certified appraisers.

Guided by a comprehensive view of historical patterns and current metrics, farmers can make informed decisions, recognizing that while fluctuations may occur, agricultural land remains a fundamentally sound investment. As market conditions evolve, the combination of detailed benchmark analysis and the expertise of appraisal professionals will remain invaluable tools for navigating these transformations.

Reach out to the local appraiser in your area to discuss your appraisal needs. And subscribe to our monthly Appraisal Report podcast for insights and expertise on all things farm real estate from our team of appraisers.

-270x321-0145788.png)